About Estate Planning Attorney

Indicators on Estate Planning Attorney You Need To Know

Table of ContentsAn Unbiased View of Estate Planning AttorneySome Known Details About Estate Planning Attorney The Definitive Guide for Estate Planning AttorneyIndicators on Estate Planning Attorney You Should Know

Estate planning is an action plan you can utilize to establish what happens to your possessions and responsibilities while you live and after you die. A will, on the various other hand, is a legal file that outlines exactly how properties are dispersed, who deals with kids and pet dogs, and any kind of various other wishes after you die.

The administrator likewise needs to pay off any kind of taxes and financial debt owed by the deceased from the estate. Creditors normally have a limited quantity of time from the day they were informed of the testator's fatality to make claims against the estate for cash owed to them. Insurance claims that are rejected by the executor can be brought to justice where a probate judge will certainly have the final say regarding whether the insurance claim stands.

The smart Trick of Estate Planning Attorney That Nobody is Discussing

After the stock of the estate has actually been taken, the worth of possessions calculated, and taxes and debt paid off, the administrator will then look for permission from the court to disperse whatever is left of the estate to the recipients. Any estate taxes that are pending will certainly come due within 9 months of the date of fatality.

Each individual areas their assets in Get the facts the trust and names someone other than their spouse as the beneficiary., to support grandchildrens' education and learning.

Excitement About Estate Planning Attorney

Estate organizers can collaborate with the contributor in order to lower taxable income as a result of those contributions or develop strategies that make the most of the result of those donations. This is an additional approach that can be used to limit fatality taxes. It includes a specific securing in the present value, and thus tax responsibility, of their residential property, while connecting the worth of future development of company website that resources to one more individual. This method involves cold the worth of a property at its worth on the day of transfer. Appropriately, the quantity of possible resources gain at death is also iced up, allowing the estate organizer to approximate their possible tax responsibility upon death and far better prepare for the settlement of revenue taxes.

If enough insurance policy earnings are available and the policies are properly structured, any type of earnings tax obligation on the deemed personalities of properties adhering to the death of an individual can be paid without considering the sale of properties. Proceeds from life insurance coverage that are obtained by the beneficiaries upon the death of the guaranteed are generally earnings tax-free.

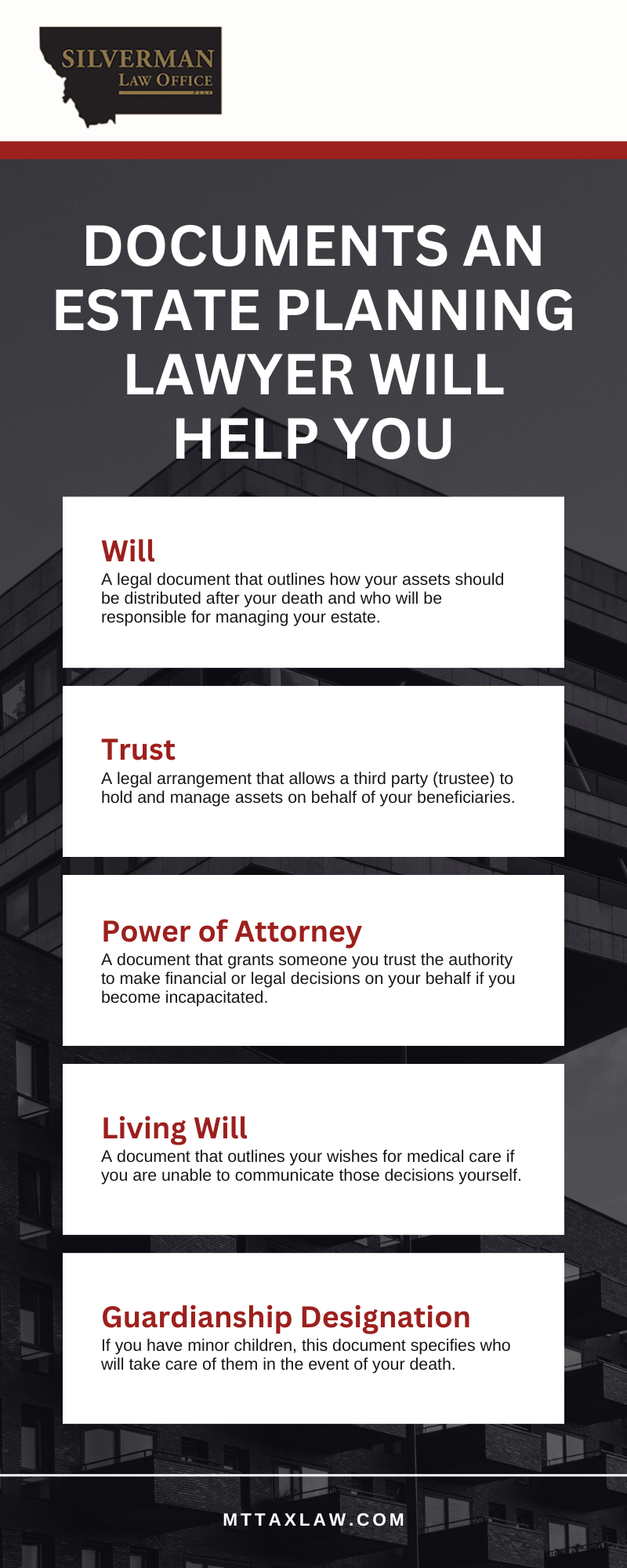

There are particular documents you'll require as part of the estate planning procedure. Some of the most usual ones consist of wills, powers of attorney (POAs), guardianship designations, and living wills.

There is a myth that estate planning blog is only for high-net-worth individuals. But that's not true. Estate preparation is a tool that every person can use. Estate intending makes it simpler for individuals to identify their desires before and after they pass away. In contrast to what lots of people think, it extends beyond what to do with possessions and liabilities.

The Greatest Guide To Estate Planning Attorney

You should start intending for your estate as quickly as you have any type of quantifiable property base. It's a continuous procedure: as life advances, your estate plan should change to match your circumstances, in line with your brand-new goals.

Estate planning is commonly believed of as a tool for the well-off. Estate preparation is additionally a great way for you to lay out plans for the treatment of your minor youngsters and pet dogs and to detail your desires for your funeral service and preferred charities.

Eligible candidates that pass the examination will be formally certified in August. If you're qualified to rest for the exam from a previous application, you may submit the short application.